If you are in the market to buy a home, you need your Realtor to provide you with some information so that you will know what to offer to increase your chances of getting the home of your dreams.

Before we get to far into this discussion, one of the first things you need to do as a buyer is to be realistic about what you want and what you can afford. Before you do anything else, talk to your lender or the lender that your Realtor has suggested so that you really know what you can afford. That way, you will only be looking at homes in your price range. One more suggestion, although you may not follow it, stop wasting your time on websites that do not maintain current listing information online. I will explain why below. Your Realtor probably has a website with current listings and a search program that will give you information on all available listings.

If you search on Trulia or Zillow, you will see information on homes that are not for sale or for which the sellers have already accepted an offer. They don’t keep their site cleaned up and don’t remove homes that are no longer available. They also show what are called “Pre-Foreclosure Homes” which are homes in which the owner has missed a payment. They are not in foreclosure. They are not for sale. If they ultimately go into foreclosure, it could be a year or more before they are for sale. Don’t waste your time looking at these homes and asking your Realtor to show them to you. If you choose to look at a website other than the one provided by your Realtor, look at Realtor.com or the local multiple listing service (MLS) for your area.

When I get a new buyer client, I always set up a search directly on the local MLS, searching for homes that meet the criteria provided by the buyer. That way they see only homes that are actually for sale.

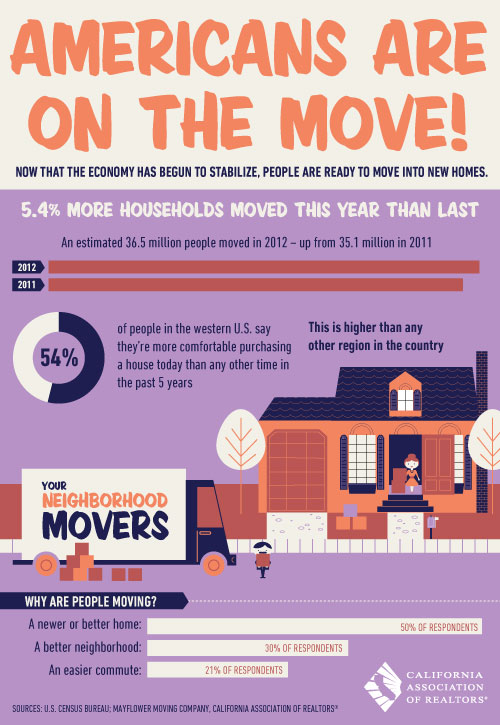

Okay, sorry to rant; but more clients are discouraged by finding homes online only to find out that they are no longer available. We are currently in a severe housing shortage. Very few listings and they all sell for much more than list price, unless they are dumps. That is also very discouraging to my buyers. They really want to be able to find homes that meet their needs and their budget and for which they have some hope of buying.

Another fact of life in our current market is that with such a shortage of inventory, cash is king and buyers who are getting a loan to buy a home miss out on too many homes. In fact, most FHA and VA buyers never get into a home when inventories are as low as they are today-unless they buy a new construction home. Make sure that you are working with a Realtor when looking at a new construction home. Remember, the agent at the development is working for the seller, not you.

That leaves us with the question, “How does a buyer know how much to offer?” on the home of their dreams. In order to answer that question, you need to understand how sellers price their homes, and you need to know where we are in the basic supply and demand cycle. Are we in a buyer’s market or are we in a seller’s market? The market we are in determines how much we offer and what concessions we can expect, if any, from the seller.

The real estate market is made up of many factors. The major market factors that your Realtor should discuss with you are Months of Inventory, Days on Market, List Price vs. Sale Price, Price Range for Sold Properties. Your Realtor should also explain the type of market we are currently experiencing; a buyers market, a sellers market or a balanced market.

To get an idea of property values, your Realtor doesn’t do an appraisal of the home you want to buy. They will do what is called a market analysis or a competitive market analysis, generally called a CMA. All of the above items can be found on the CMA, except for the months of inventory and the type of market.

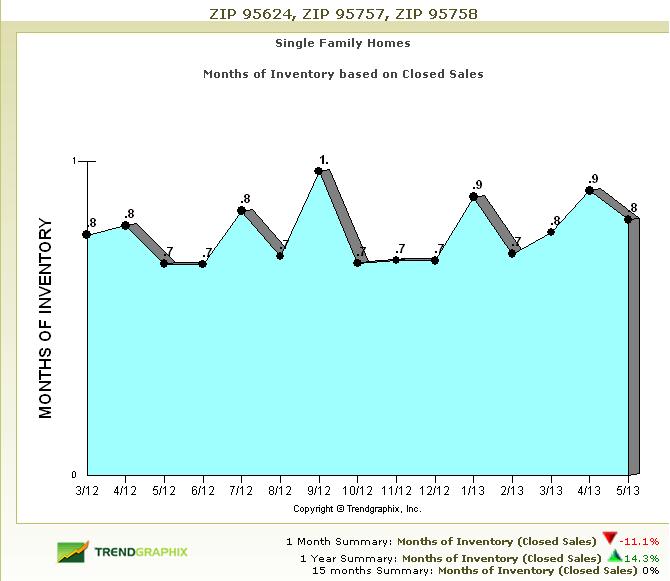

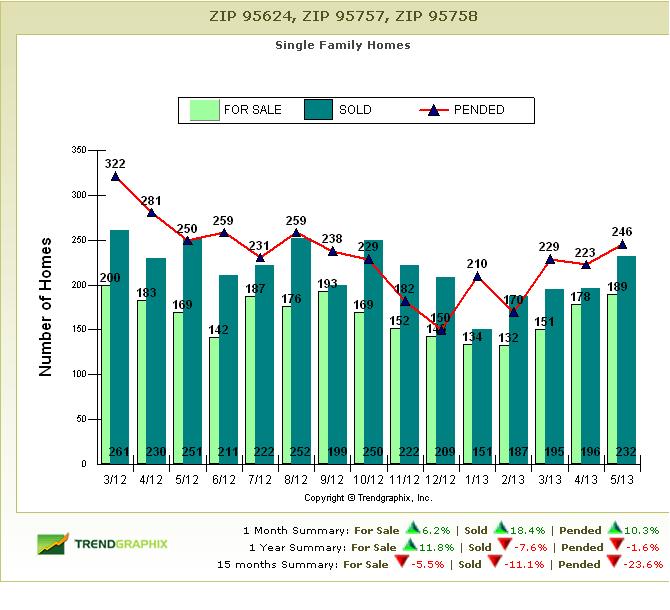

Months of Inventory: When a Realtor examines the number of homes on the market and the rate at which they are being sold, they will be able to tell you how many months of inventory we have in the market. This is one of the most important factors to consider. In the greater Sacramento area, if there is less than about 5 months of inventory on the market, we call that a seller’s market. That is because there are more buyers than sellers. That means that buyers pay more because they are fighting over fewer homes. Supply and demand. Not enough supply, and the prices go up. If there is more than about 7 months worth of inventory, we are approaching a buyer’s market. More sellers than there are buyers. The supply is too high and the sellers have to compete, lower prices or offer incentives, to get their houses sold. If we have 5-7 months of inventory, we have a balanced market and approximately an equal number of buyers and sellers.

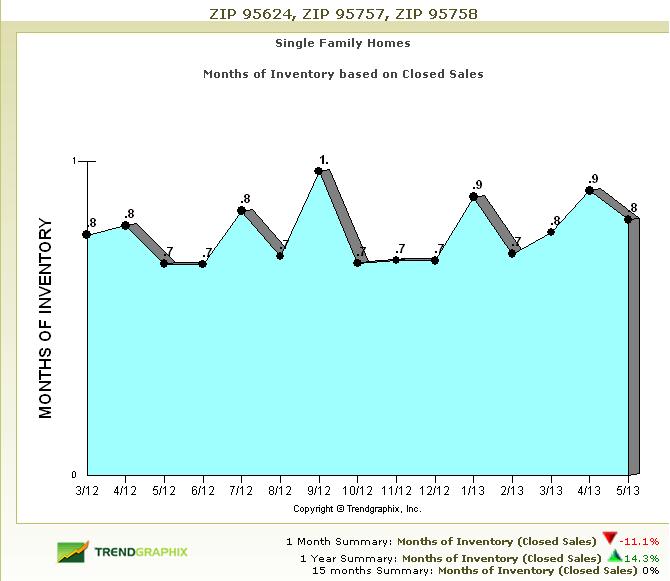

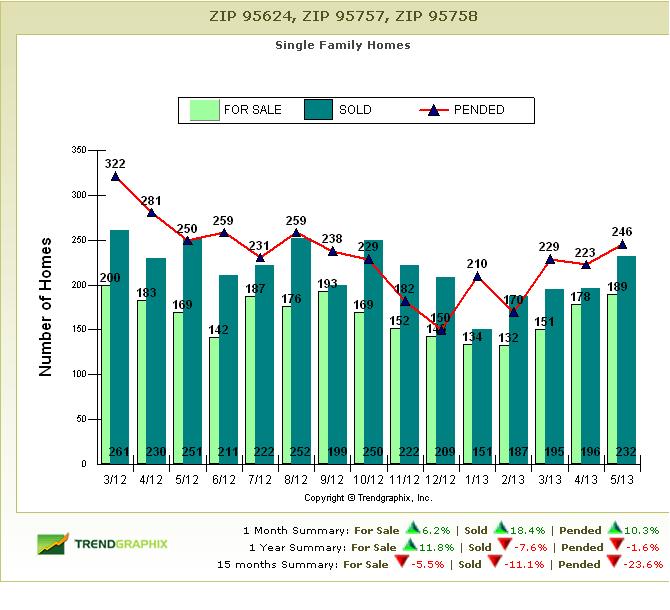

So, what should your Realtor show you? They should be able to provide “Trend Analysis Charts” that show inventory over time. They should be able to tell you what kind of market we are experiencing. You can see a current Trend Analysis Chart on my website at this link. Here is an example of a Trend Analysis Chart showing inventory.

As you can see from this chart, we have had less than a month of inventory over the past several months. As noted above, this is a strong seller’s market. Sellers will be able to price higher and will be able to ask for concessions from buyers. For example, sellers may ask the buyer to pay all of the closing costs, rather than splitting them as they might do in a balanced market. That means that as a buyer, you need to expect to pay more and to be willing to pay the closing costs if you expect your offer to be accepted.

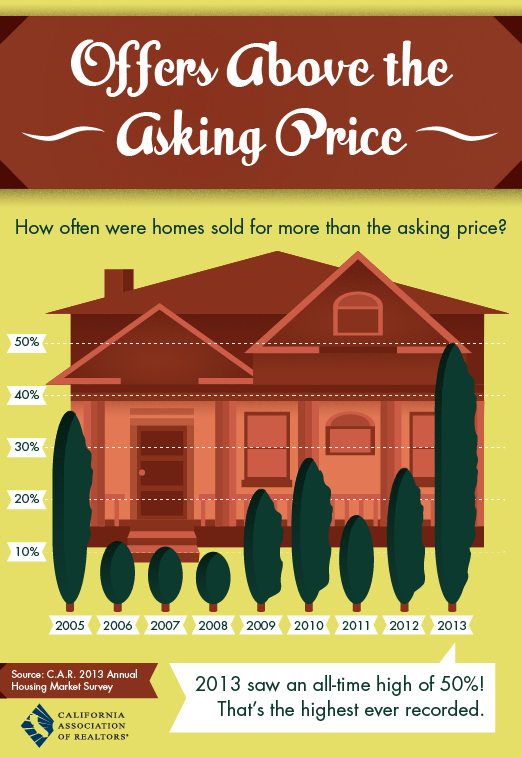

Another trend graphic that they might provide would show the relationship between the list price and the sold price. If the sold price is generally higher than the list price, that means that the buyers are offering to pay more for the property than what the seller is asking.

If you are a buyer in this kind of market, if you don’t offer above list price, your offer will generally be rejected. Great for the seller, not so great for the buyer. This would not be the time to try to lowball the offer. That would be a waste of everyone’s time and you won’t get the house.

The CMA: The Competitive Market Analysis is a very important tool that your Realtor should provide before you ever write an offer so that you can see, the average days on the market, the sale price of recently sold properties, cost per square foot of active listings and sold listings, and finally list price vs. sold price of recent sales. Keep in mind that the CMA by itself cannot answer every question; because it is just a numerical summary. A market snapshot. It does not take into consideration the condition of the other homes as compared to the one you want to buy. You will need your Realtor’s experience to bring that factor into the discussion.

Interest Rates: Although none of us has any control over the interest rates, they do play a roll in the market. If the rates are too high many potential home buyers will be priced out of the market. Just keep in mind that the higher the interest rates, the lower you will qualify to buy. Also, keep in mind that if rates are going up after you already have an offer in place, don’t be surprised if the sale falls apart; especially if you don’t have any flexibility to come up with more money to close the deal. When you make an offer, one of the factors that determines how much you can pay is the interest rates. The higher the interest rate, the lower the purchase price you can be qualified for. You may qualify for $200,000 when the rates were at 4%, but may only qualify for $180,000 if the rates jump up to 5%. Make sure that you have talked with your lender about locking the rates when you have your offer accepted and know that you will be closing within 30 days.

Appraisal: Before a lender will approve a loan, they need an appraisal of the property to know what it is worth. Additionally, based on the type of loan, the lender will only loan a certain percentage of the appraised value of the home. If the lender’s appraiser says that it is worth $200,000 and you are an FHA buyer, the lender will only loan $193,000 towards the purchase. You have to bring in the down payment and any closing costs you have agreed to pay. If you have offered $225,000 because of the competitive market, the lender will still only lend $193,000 towards the purchase. You will need to bring in an additional $25,000 in cash to close the deal.

When the appraiser looks at the market to determine the value of the home, they will be primarily looking at recent closed sales of similar homes. In a rising market, they will look at current listings and pending sales and may adjust their estimate of the value based to market movement, but the primary factor will be recently closed home sales. That is one of the reasons that appraisals sometimes come in lower than hoped; because the prices are rising too fast for the closed sales to keep up.

When this happens, FHA and VA buyers find it almost impossible to compete with all cash or conventional buyers. FHA and VA buyers generally don’t have the extra funds to make up the difference in an appraisal and the current offers being given when the market is rising quickly.

In summary, I hope I have given you some valuable information that you can use in selecting a Realtor and in choosing the price you will offer for the home of your dreams. Now, let’s put together the best offer you can so that you can move on with your life’s plans as you move to your new home.

Start building your memories,

as you turn your house into a home.

As you might guess, this document is a compilation of information from our own efforts as REALTORS, as well as input from other REALTORS in our Coldwell Banker office. I hope it has been of value to you. Don’t hesitate to email us with any suggestions that will make this document better for you and your fellow homeowners!

Be sure to follow us on Facebook at  www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

WANT TO USE THIS ARTICLE IN YOUR E-ZINE OR WEB SITE? You can, as long as you include this complete blurb with it: Jack Edwards, your real estate advocate, specializes in helping buyers and sellers in Elk Grove, CA, and the greater Sacramento area. Get information about available homes online at:

www.ElkGroveRealEstate.comOur mobile clients can find us at

Mobile.ElkGroveRealEstate.com BRE License # 01331087

|

©2013 Coldwell Banker Real Estate LLC. All Rights Reserved. Coldwell Banker® is a registered trademark licensed to Coldwell Banker Real Estate LLC. An Equal Opportunity Company. Equal Housing Opportunity. Each Coldwell Banker Residential Brokerage Office Is Owned by a Subsidiary of NRT LLC. If your property is listed with a real estate broker, please disregard. BRE License #01908304 |

|

![]() www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.