I thought long and hard about the title of this blog post. I did not want to date it by saying Pricing Your Home to sell in 2013 because the principles remain the same, regardless of when you are pricing your home to sell. I tried out several other titles, but finally ended on Pricing Your Home To Sell In Today’s Market.

I know that most people would say that the value of a home or other property is primarily controlled by location. I am sure that you have heard the old expression, “There are three things that determine the value of the property; Location, Location and Location.” So keep that in mind when you are buying, but now that you own it, you cannot easily change the location, so we are not going to dwell on that aspect too much.

I think the most important determiner that you need to understand, and come to grips with, is that your home is only worth what a ready and willing buyer will pay for it. It has nothing to do with what you think your home is worth. It only has to do with what the buyer thinks it is worth.

There are several factors that the buyer will consider, and those factors are what we will be convering today in this blog post.

First of all, the buyer will be driven by the current market factors. Inventory, interest rates and the overall mood of the economy. If the buyer is going to get a loan to buy the property, they they will also have to consider the appraisal value of the home as well because the lender will not loan them more than the lender believes the property is worth, and that will be determined by an appraisal.

Keep these factors in mind when you sit down with your Realtor to discuss pricing your home. If your Realtor knows his or her job, they will take you through a process to explain the various factors that are most important in determining how to price your home so that it will sell in the current market. When you are interviewing your potential Realtor, ask them how they are going to price your home. If they don’t explain this process, or a reasonably similar process with you, you may want to consider interviewing another Realtor.

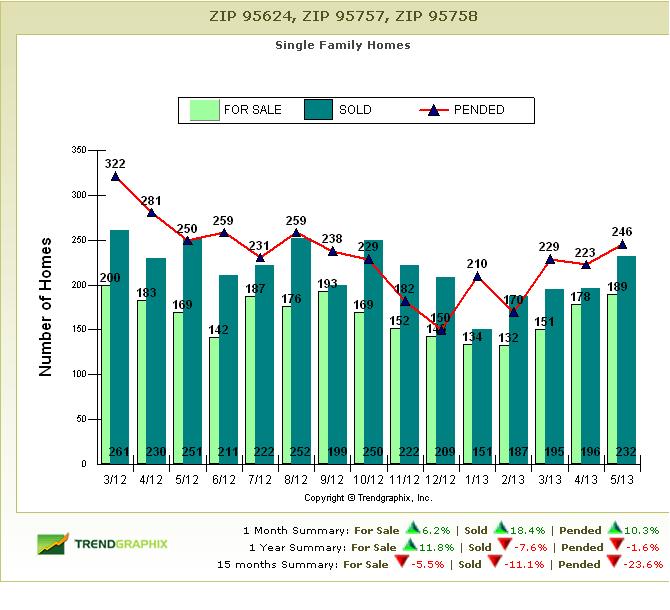

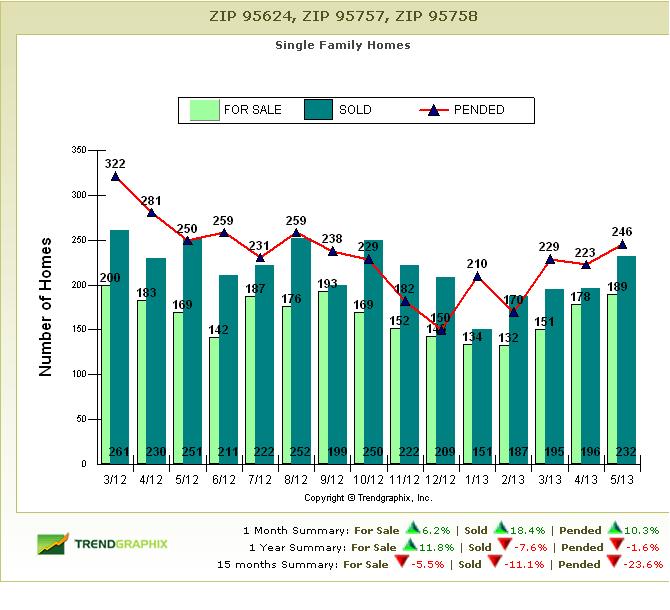

So, what should they be explaining to you? The major items should be Months of Inventory, Your Competition, Days on Market, List Price vs. Sale Price, Price Range for Active Properties and Price Range for Sold Properties. They should also explain the type of market we are currently experiencing; a buyers market, a sellers market or a balanced market.

Keep in mind that Realtors generally don’t do an appraisal of your home. They will do what is called a market analysis or a competitive or comparitive market analysis, generally called a CMA. All of the above items can be found on the CMA, except for the months of inventory and the type of market.

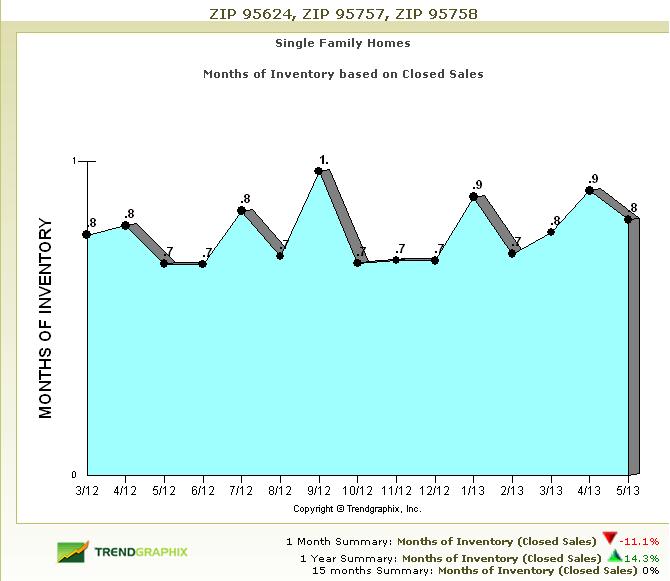

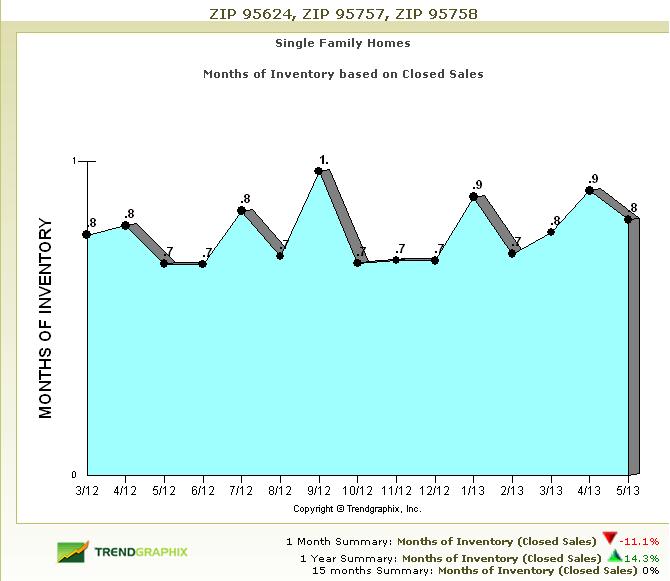

Months of Inventory: When a Realtor examines the number of homes on the market and the rate at which they are being sold, they will be able to tell you how many months of inventory we have in the market. This is one of the most important factors to consider. In the greater Sacramento area, if there is less than about 5 months of inventory on the market, we call that a seller’s market. That is because there are more buyers than sellers. That means that buyers pay more because they are fighting over fewer homes. Supply and demand. Not enough supply, and the prices go up. If there is more than about 7 months worth of inventory, we are approaching a buyer’s market. More sellers than there are buyers. The supply is too high and the sellers have to compete, lower prices or offer incentives, to get their houses sold. If we have 5-7 months of inventory, we have a balanced market and approximately an equal number of buyers and sellers.

So, what should your Realtor show you? They should be able to provide “Trend Analysis Charts” that show inventory over time. They should be able to tell you what kind of market we are experiencing. You can see a current Trend Analysis Chart on my website at this link. Here is an example of a Trend Analysis Chart showing inventory.

As you can see from this chart, we have had less than a month of inventory over the past several months. As noted above, this is a strong seller’s market. Sellers will be able to price higher and will be able to ask for concessions from buyers. For example, sellers may ask the buyer to pay all of the closing costs, rather than splitting them as they might do in a balanced market.

Another trend graphic that they might provide would show the relationship between the list price and the sold price. If the sold price is generally higher than the list price, that means that the buyers are offering to pay more for the property than what the seller is asking.

If you are a buyer in this kind of market, if you don’t offer above list price, your offer will generally be rejected. Great for the seller, not so great for the buyer. Although we are generally talking about pricing your home to sell, buyers should keep in mind that they will want their Realtors to go through a similar process with them so that they will be prepared to present an offer that has a reasonable chance of being accepted by the seller. This would not be the time to try to lowball the offer. That would be a waste of everyone’s time.

The CMA: The Competitive Market Analysis is a very important tool that your Realtor should provide so that you can see your competition, the average days on the market, the sale price of recently sold properties, cost per square foot of active listings and sold listings, and finally, list price vs. sold price of recent sales. Keep in mind that the CMA by itself cannot answer every question because; it is just a numerical summary. A market snapshot. It does not take into consideration the condition of the other homes as compared to yours. You will need your Realtor’s experience to bring that factor into the discussion. Realtors know that you have done your own comparison of your home with the one down the street that sold last year, and of course, you believe that yours is better and should sell for more that that home sold for; but you need to listen to your Realtor as they provide the additional information that will allow you to price your home to sell. Remember, your Realtor wants your home to sell as much as you do. They know that if it is overpriced it won’t sell. If it is underpriced you will never recommend them to your friends and family. They want to price it right so that you get the maximum profit from the sale of your property.

Interest Rates: Although none of us has any control over the interest rates, they do play a roll in the market. If the rates are too high, and your home is priced too high, many potential home buyers will be priced out of the market. Just keep in mind that the higher the interest rates, the fewer buyers you will have bidding on your property. Also, keep in mind that if rates are going up after you already have an offer in place, don’t be surprised if the sale falls apart, especially if the buyer does not have any flexibility to come up with more money to close the deal. When the buyer makes an offer, one of the factors that determines how much that buyer can pay is the interest rates. The higher the interest rate, the lower the purchase price an individual can be qualified for. They may have qualified when the rates were at 4%, but may not qualify if the rates jump up to 5%. Make sure that your Realtor is asking the buyer’s agent if they have locked in their loan when we are experiencing rising interest rates.

Overall mood of the economy: This is more subjective than the other factors. How do you think everyone feels about the economy? Are things moving along at an even pace? Are we in a recession? Is there run-away inflation? If people feel good about the economy, and of course if they are confident in their job, they are willing to commit to a large expense like a house. If they don’t feel good about the economy, they won’t buy.

Appraisal: Before a lender will approve a loan, they need an appraisal of the property to know what it is worth. Additionally, based on the type of loan, the lender will only loan a certain percentage of the appraised value of the home. If the lender’s appraiser says that it is worth $200,000 and the buyer is an FHA buyer, the lender will only loan $193,000 towards the purchase. The buyer has to bring in the down payment and any closing costs. If the buyer has offered $225,000 because of the competitive market, the lender will still only lend $193,000 towards the purchase. The buyer will need to bring in an additional $25,000 in cash to close the deal.

When the appraiser looks at the market to determine the value of the home, they will be primarily looking at recent closed sales of similar homes. In a rising market, they will look at current listings and pending sales and may adjust their estimate of the value based to market movement, but the primary factor will be recently closed home sales. That is one of the reasons that appraisals sometimes come in lower than hoped; because the prices are rising too fast for the closed sales to keep up.

When this happens, you will notice that FHA and VA buyers find it almost impossible to compete with all cash or conventional buyers. FHA and VA buyers generally don’t have the extra funds to make up the difference in an appraisal and the current offers being given when the market is rising quickly.

The point of all of this for the seller is to keep in mind, that when you price your home in a fast rising market, the pool of potential buyers has been reduced because generally only the cash or conventional buyer can qualify to buy your home.

Finally, you may believe that you don’t have any control over the appraisal; but, in fact, you do. The better you prepare your home for sale, the higher it will appraise. Make sure that your Realtor has given you information on getting your home ready to sell so that you will not only get a higher offer, but so that when the appraiser visits your home, they will see the additional value of your home over the competition. Make sure to look at your home as a buyer or appraiser will look at it. Examine it from the street. Does it pop? Is it clean? Is the front door freshly painted? Do the locks work easily and the hinges not squeak? What is the first impression that the buyers and the appraiser will have when they approach your home? Do the kitchen and bathrooms sparkle? If not, they should.

If you have put a lot of money into recent upgrades, take some time to prepare a write up that explains the upgrades and the costs, and leave it on the kitchen counter for potential buyers. When the appraiser visits, they will see it as well. You want buyers as well as the appraiser to see all of the value in your home so that it will appraise as high as possible.

In summary, I hope I have given you some valuable information that you can use in selecting a Realtor and in pricing your home to sell in today’s market. Now, let’s get your home sold so that you can move on with your life’s plans as you move to your next home.

Start building your memories,

as you turn your house into a home.

As you might guess, this document is a compilation of information from our own efforts as REALTORS, as well as input from other REALTORS in our Coldwell Banker office. I hope it has been of value to you. Don’t hesitate to email us with any suggestions that will make this document better for you and your fellow homeowners!

Be sure to follow us on Facebook at  www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

WANT TO USE THIS ARTICLE IN YOUR E-ZINE OR WEB SITE? You can, as long as you include this complete blurb with it: Jack Edwards, your real estate advocate, specializes in helping buyers and sellers in Elk Grove, CA, and the greater Sacramento area. Get information about available homes online at:

www.ElkGroveRealEstate.comOur mobile clients can find us at

Mobile.ElkGroveRealEstate.com BRE License # 01331087

|

©2013 Coldwell Banker Real Estate LLC. All Rights Reserved. Coldwell Banker® is a registered trademark licensed to Coldwell Banker Real Estate LLC. An Equal Opportunity Company. Equal Housing Opportunity. Each Coldwell Banker Residential Brokerage Office Is Owned by a Subsidiary of NRT LLC. If your property is listed with a real estate broker, please disregard. BRE License #01908304 |

|

![]() www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.