We’ve seen signs of an improving housing market all around us here in the Sacramento and Lake Tahoe region. Home sales have picked up, buyer demand is strong once again, and prices are ticking higher in many areas. Now, a number of key industry reports confirm what we’ve been seeing in our backyard – the nation’s housing market appears to be on the road to recovery.

The most recent S&P/Case-Shiller Home Price Index, one of the most widely followed housing market reports in metropolitan areas around the country, shows that U.S. home prices rose 1.6% in July compared to a year ago. Every city in the 20-city composite has seen prices rise for three consecutive months – in fact, four months, with the exception of Detroit.

“The news on home prices in this report confirm recent good news about housing,” said David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Single family housing starts are well ahead of last year’s pace, existing home sales are up, the inventory of homes for sale is down and foreclosure activity is slowing. All in all, we are more optimistic about housing.”

S&P isn’t alone in its upbeat assessment. A number of industry analysts and leading business publications, fromForbes magazine to the Wall Street Journal, have reported that the nation’s real estate market has turned the corner and is heading higher once again.

Last month the National Association of Realtors® announced that existing home sales rose 9 percent nationally in August from the previous year, the latest in a string of year-over-year monthly gains in the market.

“The housing market is steadily recovering with consistent increases in both home sales and median prices,” said Lawrence Yun, NAR’s chief economist. “More buyers are taking advantage of excellent housing affordability conditions.”

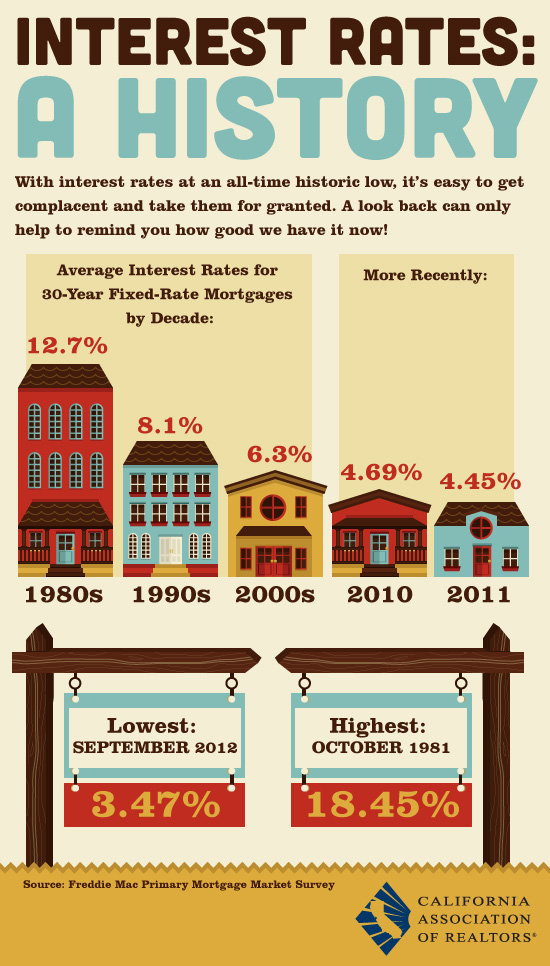

Record-low mortgage interest rates have helped propel demand for new and existing homes. Additionally, gradual improvements in the labor force and the overall economy as well as recent gains in the stock market that have brought key indices back to pre-recession highs, are adding to consumer demand.

Mortgage rates continue to hit all-time lows. Freddie Mac reported that at the end of September, 30-year fixed-rate mortgages averaged 3.40 percent while 15-year fixed-rate mortgages averaged 2.73 percent, both record lows. A year ago at this time, the 30-year mortgage was over 4 percent.

“Fixed mortgage rates continued to decline this week, largely due to the Federal Reserve’s purchases of mortgage securities, and should support an already improving housing market,” said Frank Nothaft, vice president and chief economist for Freddie Mac.

With all signs pointing to a rebound underway, the question now becomes how quick the turnaround will be and what it all means for potential homebuyers, sellers and the future of the real estate market.

Of course, nobody has the luxury of a crystal ball so predicting the future is impossible. However, many industry observers believe we’ll see a slow but steady improvement in the coming years, both in terms of sales volume and home price appreciation in the low to mid single digits.

This kind of gradual improvement may not be as exciting for homeowners or investors as the red-hot market of the early-mid 2000s, but it could provide the solid foundation we need to build a healthy, stable housing market once again.

The three most important words in real estate have always been “location, location, location,” so it’s not surprising that the pace of recovery will vary depending upon the location of the housing market. On a broad scale, NAR has pegged the West for some of the nation’s fastest rebounds.

Within the West, CoreLogic, the financial information firm, recently named Utah as one of the 10 fastest recovering housing markets in the U.S. with an 8.3 percent price appreciation over the past year, and Colorado also among the top 10 states with a 6.2 percent price gain.

California is also seeing a solid rebound. Following a decrease in median home prices in 2011, the California median may climb a projected 10.9 percent in 2012 to $317,000, according to the California Association of Realtors®. Coastal areas are projected to outpace inland regions.

NAR’s Yun said inventories of homes for sale in many parts of the country are balanced, favoring neither sellers nor buyers, after years of a surplus. But markets in the West are experiencing inventory shortages, which are placing pressure on prices. We’ve seen that in some of our local markets here in the Sacramento and Lake Tahoe region.

Homebuilders have certainly taken notice of the recovery. New home construction is on the rise once again across the country. Housing starts – a key forward-looking barometer of the market – was up a whopping 29 percent in August compared to last year, according to the U.S. Census Bureau.

Still, with housing construction down significantly throughout the recession, it could take several years for new construction to make its way through the pipeline and bring new home inventories back to normal levels.

That imbalance has already led to bidding wars in some cities, and it makes a handful of industry analysts think prices could rise faster than expected in the coming years. NAR’s Yun is one of them.

Despite accelerated construction of new homes this year and next, Yun said the increased inventory is “insufficient to meet the growing housing demand. “ As a result, he estimates that prices of existing homes could rise 10 percent cumulatively over the next two years on sales increases of 8-9 percent in 2012, and 7-8 percent in 2013.

Of course, the housing market will continue to face economic and political challenges that could change those forecasts. Other factors could arise in some geographical areas due to weather or other unexpected events.

There’s always the chance that the nation’s economic recovery could slow further, that the job market softens, and that the so-called fiscal cliff leads to higher taxes and sharp spending cuts – all potentially reducing demand for homes.

But barring a sudden turn in the economy, Forbes magazine and others say it appears that the worst of the housing downturn is behind us and a solid foundation has been laid for a slow but steady recovery in the market.

So if you’ve been sitting on the sidelines waiting for the housing market to turn the corner, now may be a great time to jump in while prices are still very affordable and interest rates are at record lows. For homebuyers, that’s a rare combination that simply won’t last forever. Please give me a call and together we’ll find the home of your dreams.

Start building your memories,

as you turn your house into a home.

As you might guess, this document is a compilation of information from our own efforts as REALTORS, as well as input from other REALTORS in our Coldwell Banker office. I hope it has been of value to you. Don’t hesitate to email us with any suggestions that will make this document better for you and your fellow homeowners!

Be sure to follow us on Facebook at ![]() www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.

www.Facebook.com/ElkGroveRealEstate. For information about properties available for sale and for more information for buyers and sellers, please visit our website at www.ElkGroveRealEstate.com and don’t hesitate to give us a call or drop us an email with your questions.